Hello Clients and Friends -

Summer is in full swing; I hope you are all fine and dandy.

There were both areas of worry and optimism in the past three months as the American economy started the re-open after the Corona Virus vaccines were made available and taken by many American’s during the first quarter.

Interest rates moved up considerably in the first quarter, as investors braced

themselves for the possibility of a rise in inflation. The June inflation numbers

just released show car prices soaring higher (+2% new cars, +10.5% used cars),

along with fuel and energy prices both up sharply in one month! Apparel was up 0.7% on top of May’s +1.2%.

Food prices rose 2.4% year-over-year, while food away from home was +4.2%. Check your menu carefully folks before ordering. Gasoline and fuel oil rose +2-3% each in June and are

+40% year-over year. Crude Oil prices have almost doubled since April, and Florida

gasoline prices, where I live, are up about 30% to around $3.00 a gallon since

Joe Biden took office! This ties in with our Gold ownership thesis described below.

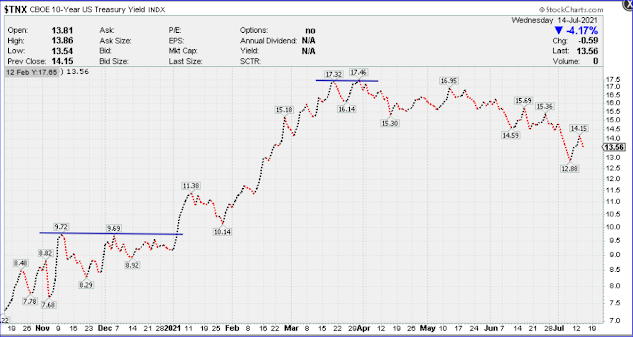

Here is a chart of the 10 year Treasury Note, a very important security that’s used for all types of borrowing purposes; like loans and mortgages.

This chart shows the interest rate yield daily going back to October, 2020.

The

blue line to the left on the chart shows the near 1% level in the Treasury Note,

which was broken on the upside in January. The second blue line in the middle shows

the double top around 1.75% in April. Today, the 10-year U.S. Treasury note sits

at 1.30%. That’s quite a swing in interest rates, and this has a big

impact on bond prices along with loans as a borrower. The 20+ Year U.S.

Treasury Bond Exchange Traded Fund (ETF) is used in our portfolio construction

for clients, as it provides better protection in poor stock markets. That bond

gained +7% in price the last 3 months, erasing some of its losses for

the year as interest rates fell. The last bastion of safety in falling stock markets is Treasury Bonds. This bond gained 14% in 2008, when stock prices fell over 30%!

Treasury bonds should perform okay during prosperity and deflationary times, and do really well during stock meltdowns. They are virtually free of currency, political, default and credit risks.

Does this inflation being reported worry the Federal Reserve, whose two jobs are to control inflation and seek near-full employment? Thus far, they are notready to raise interest rates to stem the inflation risks cited above, so that jury is out on that decision for now.

The Virus opened our eyes to the resiliency of the American economy; in that consumers are back to spending. The Government relief and stimulus plans aided many at the lower end of the economic strata moreso, so we’ll see if that trend continues into the Summer and Fall.

I think inflation will rise more when this economy gets fully re-opened. It’s hard to see why NOT with more money in supply, and pent up demand to travel, eat away from home; you know, the types of activities we took for granted pre-2020.

Stocks moved higher into early May, then essentially moved sideways until late June, when they spurted ahead almost 3% in as many weeks into marginally new highs. The broader market indexes, Dow Jones and S&P 500 – gained 5% and 8% in the second quarter respectively. For the 6 months, stocks moved up around 12% to 14% higher.

Gold

is our backstop on disaster-type events politically and economically. Call it Portfolio

Fire Insurance. Gold has a long record of protecting your purchasing

power caused by inflation also.

Gold has perked up of late, and has tacked on $65

an ounce just since the end of June, so maybe that’s a trend that’ll continue. It’s

trading near $1,830 per ounce today Thursday.

I would not be surprised if Gold trades back to the all-time highs last summer near $2,070. Do you think our world has become less stable politically and economically? If so, owning some precious metals (Gold or Silver) could prove beneficial to your finances.

I wrote an extensive blog in the Summer of 2019 on Gold; you can access here with the link: https://www.blogger.com/blog/post/edit/19951725/5388977545102494445

P.S. Thanks to those of you who reached out to me by social media, texts and E-mails on the passsing of my father recently.

I started a blog post to memorialize his life; but it's hard to finish since he accomplished so much during his lifetime. Dad was 87 and a tremendous inspiration to me in this business over the past 35 years.

~Barry Unterbrink

So glad that you are now home in your comfy-space recovering. I hope to visit you soon when down your way. My generic client letter is below, followed by your specific account management copy.

Last July, I started off my client letter with the headline “What a half year!” It is again appropriate to keep that same headline for the second half of 2020!

The pandemic, and its economic impact continued into the Summer, along with the political / social unrest that ruled the headlines. The upside to the second half was: Wall Street Did Not Take Notice of Most of This! Stocks gained handily in the last 6 months, the Dow Industrials rose 4,100 points or +15% to close 2020 above Dow 30,000. The stock market has not closed a year at a new all-time high since 2013, so that’s somewhat significant. It ended December making its 14th record close of the year. The full year 2020 saw the Dow Industrial Stocks rise 10%.

Of the sectors of our economy that benefitted last year, Technology, Industrials, and Consumer Discretionary stocks did the best. Energy, Real Estate and Utilities were the bottom feeders. You owned technology and Consumer stocks for a good portion of last year.

The

bond market performed rather well also for the year. The massive money-printing

by the Federal Reserve, and the falloff in economic activity has not given them

any reason to raise rates with inflation low (+1.4% in 2020), and a weak labor

market (our unemployment rate is 6.7%, or 11 million folks looking for work).

Other

categories of bonds – corporate, municipal turned in +5% to +7% total returns

last year. If a bond can provide income and keep you ahead of inflation and the

tax on the bond interest, then you are net/net ahead. That may not be the case

every year, so be aware of that as a bond investor.

Our favorite precious metal, Gold – after a robust +17% gain the first half of 2020, tacked on $120/ounce more the last half of the year, boosting it’s total 2020 gain to +$370 an ounce; good enough for a +24% gain. After Gold prices were break-even in 2018, Gold has gained +47% combined in 2019-2020. All investor portfolios own Gold ETF’s to some extent as a hedge against uncertainty (political, economic); which we are sure experiencing today.

Your biggest gains realized were in and Technology, +$6,800 and the NASDAQ

market ETF, +$1,100. Your losses were American Beacon mutual fund, -$2,150 and Fidelity

HealthCare, -$1,350. Remember, these were the stocks sold. Your statement print

enclosed shows $22,915 in gains that are still owned. Since we started in the

Summer of 2018, your portfolio has gained +$25,338.

I realize that your withdrawal of money this month will lower your account balance in your IRA account, but I can work around that for now. I did manage to log in to your account this week using the info you provided. Your log-in has all the performance numbers that Fidelity doesn’t show on Dad’s login, so that’s very helpful. If asked, your security answer is: F150 for your favorite car. Also, some deep thinking has to be done on how you are going to operate with your job and finances this year and next. When you turn 55 next year, there may be options to access your retirement money outside Fidelity without any penalties. I would like to look at your ICMA account to factor that money into the equation, so arrange for me to co-ordinate that with you soon on the computer.

What’s possibly

in store for 2021?

It appears that the stock market has priced in a lot of good news that may or

may not come to fruition this year. The pandemic response and vaccination

success, getting workers back in a job, opening our schools, getting back to

our routine lives, to name just a few.

The changes in policies with the new (and majority) administration of

Democratic

leadership in both houses of Congress and the Biden/Harris White House may include:

· Taxes won’t be going down for most of us in 2021.

· Biden’s plans to shore up Social Security and Retirement Savings.

· Inflation may start to rise above the Fed’s 2% target.

· Higher interest rates may be needed to calm the increased prosperity if we do go back quickly to a “new normal” – whatever that means.

· Will Government spending spiral even more out of control?

We are content to keep advocating a balanced and diversified portfolio. One that can hold up and deliver positive results in most years under the four economic conditions of: Prosperity, Recession, Inflation, and Deflation.

Do reach out

to me if you have any questions or comments.