Has the 11 year bull market in stock prices come to an end? It sure seems so, by the flowing of plentiful red down arrows on my computer screens. Including Monday's 2,013 point loss on the Dow Jones Industrial's Average, we have fallen 5,700 points or a whopping -19.3%, before a nice +4.9% gain today. It took just 17 trading days to get a near 20% decline.

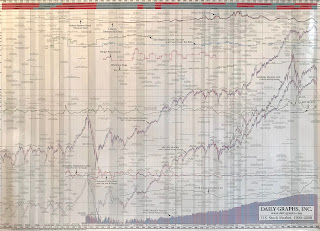

Wall Street uses terms such as 'correction' and bear market, so let's understand them. A correction is a move down of 10%, while a bear market occurs when a move down is 20%. So we're right on the cusp of a bear market, down 19.3% to be precise on Monday's close. I dispay a wall chart of the stock market and economic data starting in 1900. An interesting read for history buffs.

Bear markets occur about every 7 years on average; that's in the Post World War 2 era covering about 75 years. So there have been 10 bear markets, shown here by this table I've constructed. I've included a few corrections also if they were close to the -20%.

| Dates (date range) | Percent Loss | # Months | |||

| 1946-1948 | -24 | 36 | |||

| 1956 | -19 | 19 | |||

| 1960-1962 | -27 | 7 | |||

| 1966 | -25 | 8 | |||

| 1968-1969 | -35 | 18 | |||

| 1973-1974 | -45 | 23 | |||

| 1976 | -27 | 17 | |||

| 1978 | -16 | 20 | |||

| 1980-1981 | -24 | 15 | |||

| 1987 | -36 | 3 | |||

| 2000-2002 | -38 | 33 | |||

| 2007-2009 | -50 | 17 | |||

| 2020 - ? | -19 | 1 month |

As you can view, the time frame of bear markets is all over the map. Quick bears were in '60, '66 and 1987. Longer term, more worrisome bear markets ocurred in '46, '73-'74, 2000-2002. My father started managing pension fund money in early 1973 and surely can attest to the pain of that bear market.

The current bear market is an infant toddler, at just under one month now using the Feb. 12th Dow Jones high close.

Here's the concerns and opportunities.

First, your portfolio is rarely all stock-based, so your "personal" bear market may look very different than the table above. Owning bonds and cash - even Gold - would normally reduce your overall losses in a stock market decline.

Also, don't fret over small losses. Very few investors sell at the top. And when you sell, you immediately have another decision down the road; where to invest next, or when to get back in. It's your mix of stocks and bonds that will determine most risks in investing. So let's use the word "exchange" rather than sell when moving money around. Don't you feel better already?

Try this exercise: Track your performance of all your accounts for a day, or a week, PREFERABLY when stocks move up and down a lot, like now. Then track the Dow Jones Industrials against that for the same time-span.

If your accounts lost 3% yesterday, when the Dow lost 7%, then your "BETA" is 0.42. Three divided by 7. That is, your money lost 42% of an all-invested basket of stocks (the Dow Jones 30 stocks).

It's a bit technical, but optimally, you want a lower beta in a bear market in stocks, and a higher beta in bull markets. A beta of 1.00 would show you move in lockstep with the Dow. A beta of 1.30 shows you are agressive and will get a 30% gain over the Dow Jones. A negative beta of -1.00 would show your portfolio goes up dollar for dollar when stocks go down. Gold and precious metals vs. stocks, for instance are noted for their negative beta.

Your IRA may be in mutual funds and some Gold funds, what's your BETA? Your brokerage account contains more speculative stocks; what's that BETA? That one number will tell a lot about how you are invested risk-wise.

Generally, younger investors should have higher betas that older investors. If you're nearing retirement, your beta should normally be no more than 0.50. Why?

It takes longer to recover your money in stocks if your losses are greater at the end of the bear market. A 20% loss takes a 25% gain to get even, a 30% loss takes 43% to get back to even. If your beta is lower, you'll generally lose less in the bear stock market, and can recover your money faster in the ensuing bull market.

That could be uber-important if you have cash needs during that time, or are planning to retire not knowing when the bear market will end. The 2007-2009 bear market took 17 months to play out.

Could you postpone spending or delay your planned retirement by 3+ years if most of your money was in the stock market? The 2007-2009 bear market didn't get back to even on the Dow Jones until the Spring of 2011, a full 40 months later!

If I were to ask you what your risk reduction strategy is, how would you answer? Think about it. Some valid answers would be: lowering your portfolios beta, setting stops to sell to avoid large losses; buying an annuity or short term bonds with less risk than stocks? Adding Gold to your holdings. Ask your advisor what his plan is for you.

Hope this sheds some light on how to improve your portfolio management, and how risks are handled in our modern investing era. Call or e-mail with questions or comments.

Thanks for reading!

No comments:

Post a Comment