Here's the table. I have highlighted it in RED in care your tired eyes have trouble reading it. Mine do.

| Dates (date range) | Percent Loss | # Months |

| 2007-2009 | -54 | 17 |

| 1973-1974 | -45 | 23 |

| 2000-2002 | -38 | 33 |

| 1969-1970 | -36 | 18 |

| 1987 | -36 | 3 |

| 2020 - ? | -31.9 | 1 |

| 1961-1962 | -27 | 7 |

| 1976 | -27 | 17 |

| 1966 | -25 | 8 |

| 1946-1948 | -24 | 36 |

| 1981-1982 | -24 | 15 |

| 1956 | -19 | 19 |

| 1978-1979 | -16 | 20 |

While many stocks are down more than 30%, a few are not as badly damaged; very few. None-the-less, remember the Math. A 30% decline in a stock will take a 43% gain to get back to even. 100 / (100-30).

That may be a tall order, or one that will take months of patience to pull off. I can only hope that you are diversified with some bonds, cash and Gold to partially offset the stock prices falling.

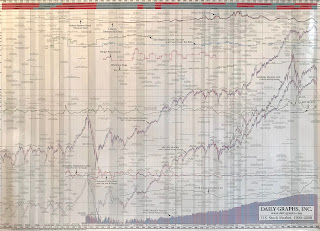

Continuing from last week's post, the stock market's been on an 11 year run, averaging +14.7% compound growth each year. If the historical long term market gain is closer to 10% per year, then consider this.

The Dow Jones could sit here at Dow 20,000 for one full year, and not move - and then you would have your +10% growth rate over the past 12 years! The move from 20,000 to near 30,000 was "gravy" so to speak. In finance, it's called 'reversion to the mean'.

Recall the last sharp BULL run in stocks; 2003-2007, almost a doubler, or +14% each year. We know what 2008-2009 gave us after the bull died (see table). Or how about 1995-1999, another 5 years, with a +26% per year barn-burner.

Then, only to see 37% lopped off prices in the 2000-2002 bear market. If you look then at the bull/bear market 8 year gains, 1995-2002, your back down to a +9.4% average gain. See the pattern here?

So any good news from this predicament? Well, sort of. When bear markets run their course, the ensuing year(s) are usually outstanding - due to pent up demand and better increasing confidence in the economy and earning prospects.

When could that happen? No human knows for sure, but when total despair and surrendar are being displayed - when all sense of purpose as an investor are erased; when there's "blood in the streets", quoted Baron Rothschild, an 18th-century British nobleman and member of the Rothschild banking family. "Buy when there's blood in the streets, even if the blood is your own."

Stay tuned.