Gold prices closed Friday at $1,733 an ounce. That's a fresh high for the precious metal dating back to late 2012. One ouce of Gold is $220 more valuable since New Year's Day, a short 4-1/2 months ago.

In fact, Gold's recent rally is much more pronounced if you look at the multi-year returns. This is shown in the table below, using the standard calculation of compounding annual growth. That shows you the gain required each year to get to your end price of $1,733.

Dollar Gain Compound Growth

2020 + $220

One year + $436 +33 %

2 years + $440 +16 %

3 years + $502 +12 %

5 years + $515 + 7 %

10 yrs. + $500 + 3.4%

15 yrs. + $1,300 + 9.4%

20 yrs. + $1,443 + 9.0%

We have advocated since 2011 to use Gold as an insurance policy against financial calamity and unforseen disasters. It may not be needed for that much of the time, but is invaluable when things get scary. This shows you the longer term GAINS in holding Gold across the years, during good and not so good times.

Notice the sub-par returns on the 5 and 10 year holding periods. That's due to the three year Gold year bear market, 2013-15 losing $600/ounce or about 1/3rd.

While you can certainly find many other time frames in which Gold underperformed other investments like stocks or bonds, we still feel a weighting of at least 10% in Gold is warranted now in most diversified (balanced) portfolios.

Gold has experienced a really good century thus far; $100 invested in stocks (S&P 500) grew to $276, while $100 in Gold bullion grew to $566. Besides the three year losses cited above, Gold prices completely ignored the 2000-2002 bear market, and the 2007-2009 Great Recesssion, rising 18% and 70% in those two time spans.

Now, you're a smarter investor, and a Gold afficianado too!

Thanks for reading!

Retirement Planning Advice and Financial Related Education by Barry Unterbrink, Chartered Retirement Planning Counselor

Monday, May 18, 2020

Gold Prices Ramp Up to 8 Year Highs

Barry Unterbrink is a fee-based Chartered Retirement Planning Counselor and wealth manager since 1982. As a second generation manager after his father Larry (1934-2021), they managed institutional pension funds totaling $100 million.Both are former Investment Advisory Presidents and financial newsletter publishers.

Barry Unterbrink is a fee-based Chartered Retirement Planning Counselor and wealth manager since 1982. As a second generation manager after his father Larry (1934-2021), they managed institutional pension funds totaling $100 million.Both are former Investment Advisory Presidents and financial newsletter publishers.

Tuesday, March 17, 2020

2020 Bear Market Extends Coronavirus Losses

The stock market's near 3,000 point loss in Monday's trading now places it in the 6th position in the list of the worst bear markets since 1946!

Here's the table. I have highlighted it in RED in care your tired eyes have trouble reading it. Mine do.

While many stocks are down more than 30%, a few are not as badly damaged; very few. None-the-less, remember the Math. A 30% decline in a stock will take a 43% gain to get back to even. 100 / (100-30).

That may be a tall order, or one that will take months of patience to pull off. I can only hope that you are diversified with some bonds, cash and Gold to partially offset the stock prices falling.

Continuing from last week's post, the stock market's been on an 11 year run, averaging +14.7% compound growth each year. If the historical long term market gain is closer to 10% per year, then consider this.

The Dow Jones could sit here at Dow 20,000 for one full year, and not move - and then you would have your +10% growth rate over the past 12 years! The move from 20,000 to near 30,000 was "gravy" so to speak. In finance, it's called 'reversion to the mean'.

Recall the last sharp BULL run in stocks; 2003-2007, almost a doubler, or +14% each year. We know what 2008-2009 gave us after the bull died (see table). Or how about 1995-1999, another 5 years, with a +26% per year barn-burner.

Then, only to see 37% lopped off prices in the 2000-2002 bear market. If you look then at the bull/bear market 8 year gains, 1995-2002, your back down to a +9.4% average gain. See the pattern here?

So any good news from this predicament? Well, sort of. When bear markets run their course, the ensuing year(s) are usually outstanding - due to pent up demand and better increasing confidence in the economy and earning prospects.

When could that happen? No human knows for sure, but when total despair and surrendar are being displayed - when all sense of purpose as an investor are erased; when there's "blood in the streets", quoted Baron Rothschild, an 18th-century British nobleman and member of the Rothschild banking family. "Buy when there's blood in the streets, even if the blood is your own."

Stay tuned.

Here's the table. I have highlighted it in RED in care your tired eyes have trouble reading it. Mine do.

| Dates (date range) | Percent Loss | # Months |

| 2007-2009 | -54 | 17 |

| 1973-1974 | -45 | 23 |

| 2000-2002 | -38 | 33 |

| 1969-1970 | -36 | 18 |

| 1987 | -36 | 3 |

| 2020 - ? | -31.9 | 1 |

| 1961-1962 | -27 | 7 |

| 1976 | -27 | 17 |

| 1966 | -25 | 8 |

| 1946-1948 | -24 | 36 |

| 1981-1982 | -24 | 15 |

| 1956 | -19 | 19 |

| 1978-1979 | -16 | 20 |

While many stocks are down more than 30%, a few are not as badly damaged; very few. None-the-less, remember the Math. A 30% decline in a stock will take a 43% gain to get back to even. 100 / (100-30).

That may be a tall order, or one that will take months of patience to pull off. I can only hope that you are diversified with some bonds, cash and Gold to partially offset the stock prices falling.

Continuing from last week's post, the stock market's been on an 11 year run, averaging +14.7% compound growth each year. If the historical long term market gain is closer to 10% per year, then consider this.

The Dow Jones could sit here at Dow 20,000 for one full year, and not move - and then you would have your +10% growth rate over the past 12 years! The move from 20,000 to near 30,000 was "gravy" so to speak. In finance, it's called 'reversion to the mean'.

Recall the last sharp BULL run in stocks; 2003-2007, almost a doubler, or +14% each year. We know what 2008-2009 gave us after the bull died (see table). Or how about 1995-1999, another 5 years, with a +26% per year barn-burner.

Then, only to see 37% lopped off prices in the 2000-2002 bear market. If you look then at the bull/bear market 8 year gains, 1995-2002, your back down to a +9.4% average gain. See the pattern here?

So any good news from this predicament? Well, sort of. When bear markets run their course, the ensuing year(s) are usually outstanding - due to pent up demand and better increasing confidence in the economy and earning prospects.

When could that happen? No human knows for sure, but when total despair and surrendar are being displayed - when all sense of purpose as an investor are erased; when there's "blood in the streets", quoted Baron Rothschild, an 18th-century British nobleman and member of the Rothschild banking family. "Buy when there's blood in the streets, even if the blood is your own."

Stay tuned.

Barry Unterbrink is a fee-based Chartered Retirement Planning Counselor and wealth manager since 1982. As a second generation manager after his father Larry (1934-2021), they managed institutional pension funds totaling $100 million.Both are former Investment Advisory Presidents and financial newsletter publishers.

Barry Unterbrink is a fee-based Chartered Retirement Planning Counselor and wealth manager since 1982. As a second generation manager after his father Larry (1934-2021), they managed institutional pension funds totaling $100 million.Both are former Investment Advisory Presidents and financial newsletter publishers.

Wednesday, March 11, 2020

Dow Jones Industrials Enter Bear Market Today

The popular Dow Jones Industrial Average officially entered a Bear Market as of 4:00 PM today, Wednesday, March 11th.

It took just 19 trading days to accomplish this - dating back to just mid-February when it closed at an all-time high of 29,551.42.

I reported in the March 10th blog post of the significance of Bear Markets, and how you can prepare for them with some risk reducing strategies with your money,

The Dow Industrials are now down 20.3%, or 5,998 points from the peak last month, February 12th to be exact!

The widely followed Standard & Poor's 500 Index, used moreso by professional investors and institutions, escaped bear market status by a thin margin Wednesday. It's down 18.9%, and would need to fall about 38 points to enter it's own -20% bear market.

Stay tuned for more news as it develops.

It took just 19 trading days to accomplish this - dating back to just mid-February when it closed at an all-time high of 29,551.42.

I reported in the March 10th blog post of the significance of Bear Markets, and how you can prepare for them with some risk reducing strategies with your money,

The Dow Industrials are now down 20.3%, or 5,998 points from the peak last month, February 12th to be exact!

The widely followed Standard & Poor's 500 Index, used moreso by professional investors and institutions, escaped bear market status by a thin margin Wednesday. It's down 18.9%, and would need to fall about 38 points to enter it's own -20% bear market.

Stay tuned for more news as it develops.

Barry Unterbrink is a fee-based Chartered Retirement Planning Counselor and wealth manager since 1982. As a second generation manager after his father Larry (1934-2021), they managed institutional pension funds totaling $100 million.Both are former Investment Advisory Presidents and financial newsletter publishers.

Barry Unterbrink is a fee-based Chartered Retirement Planning Counselor and wealth manager since 1982. As a second generation manager after his father Larry (1934-2021), they managed institutional pension funds totaling $100 million.Both are former Investment Advisory Presidents and financial newsletter publishers.

Tuesday, March 10, 2020

Is This a Bear Market? How to Plan for One

The stock market performance over the past several weeks has been atrocious.

Has the 11 year bull market in stock prices come to an end? It sure seems so, by the flowing of plentiful red down arrows on my computer screens. Including Monday's 2,013 point loss on the Dow Jones Industrial's Average, we have fallen 5,700 points or a whopping -19.3%, before a nice +4.9% gain today. It took just 17 trading days to get a near 20% decline.

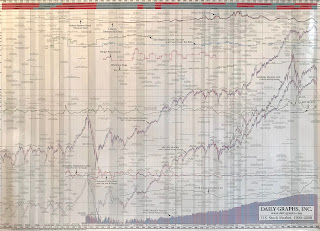

Wall Street uses terms such as 'correction' and bear market, so let's understand them. A correction is a move down of 10%, while a bear market occurs when a move down is 20%. So we're right on the cusp of a bear market, down 19.3% to be precise on Monday's close. I dispay a wall chart of the stock market and economic data starting in 1900. An interesting read for history buffs.

Bear markets occur about every 7 years on average; that's in the Post World War 2 era covering about 75 years. So there have been 10 bear markets, shown here by this table I've constructed. I've included a few corrections also if they were close to the -20%.

As you can view, the time frame of bear markets is all over the map. Quick bears were in '60, '66 and 1987. Longer term, more worrisome bear markets ocurred in '46, '73-'74, 2000-2002. My father started managing pension fund money in early 1973 and surely can attest to the pain of that bear market.

The current bear market is an infant toddler, at just under one month now using the Feb. 12th Dow Jones high close.

Here's the concerns and opportunities.

First, your portfolio is rarely all stock-based, so your "personal" bear market may look very different than the table above. Owning bonds and cash - even Gold - would normally reduce your overall losses in a stock market decline.

Also, don't fret over small losses. Very few investors sell at the top. And when you sell, you immediately have another decision down the road; where to invest next, or when to get back in. It's your mix of stocks and bonds that will determine most risks in investing. So let's use the word "exchange" rather than sell when moving money around. Don't you feel better already?

Try this exercise: Track your performance of all your accounts for a day, or a week, PREFERABLY when stocks move up and down a lot, like now. Then track the Dow Jones Industrials against that for the same time-span.

If your accounts lost 3% yesterday, when the Dow lost 7%, then your "BETA" is 0.42. Three divided by 7. That is, your money lost 42% of an all-invested basket of stocks (the Dow Jones 30 stocks).

It's a bit technical, but optimally, you want a lower beta in a bear market in stocks, and a higher beta in bull markets. A beta of 1.00 would show you move in lockstep with the Dow. A beta of 1.30 shows you are agressive and will get a 30% gain over the Dow Jones. A negative beta of -1.00 would show your portfolio goes up dollar for dollar when stocks go down. Gold and precious metals vs. stocks, for instance are noted for their negative beta.

Your IRA may be in mutual funds and some Gold funds, what's your BETA? Your brokerage account contains more speculative stocks; what's that BETA? That one number will tell a lot about how you are invested risk-wise.

Generally, younger investors should have higher betas that older investors. If you're nearing retirement, your beta should normally be no more than 0.50. Why?

It takes longer to recover your money in stocks if your losses are greater at the end of the bear market. A 20% loss takes a 25% gain to get even, a 30% loss takes 43% to get back to even. If your beta is lower, you'll generally lose less in the bear stock market, and can recover your money faster in the ensuing bull market.

That could be uber-important if you have cash needs during that time, or are planning to retire not knowing when the bear market will end. The 2007-2009 bear market took 17 months to play out.

Could you postpone spending or delay your planned retirement by 3+ years if most of your money was in the stock market? The 2007-2009 bear market didn't get back to even on the Dow Jones until the Spring of 2011, a full 40 months later!

If I were to ask you what your risk reduction strategy is, how would you answer? Think about it. Some valid answers would be: lowering your portfolios beta, setting stops to sell to avoid large losses; buying an annuity or short term bonds with less risk than stocks? Adding Gold to your holdings. Ask your advisor what his plan is for you.

Hope this sheds some light on how to improve your portfolio management, and how risks are handled in our modern investing era. Call or e-mail with questions or comments.

Thanks for reading!

Has the 11 year bull market in stock prices come to an end? It sure seems so, by the flowing of plentiful red down arrows on my computer screens. Including Monday's 2,013 point loss on the Dow Jones Industrial's Average, we have fallen 5,700 points or a whopping -19.3%, before a nice +4.9% gain today. It took just 17 trading days to get a near 20% decline.

Wall Street uses terms such as 'correction' and bear market, so let's understand them. A correction is a move down of 10%, while a bear market occurs when a move down is 20%. So we're right on the cusp of a bear market, down 19.3% to be precise on Monday's close. I dispay a wall chart of the stock market and economic data starting in 1900. An interesting read for history buffs.

Bear markets occur about every 7 years on average; that's in the Post World War 2 era covering about 75 years. So there have been 10 bear markets, shown here by this table I've constructed. I've included a few corrections also if they were close to the -20%.

| Dates (date range) | Percent Loss | # Months | |||

| 1946-1948 | -24 | 36 | |||

| 1956 | -19 | 19 | |||

| 1960-1962 | -27 | 7 | |||

| 1966 | -25 | 8 | |||

| 1968-1969 | -35 | 18 | |||

| 1973-1974 | -45 | 23 | |||

| 1976 | -27 | 17 | |||

| 1978 | -16 | 20 | |||

| 1980-1981 | -24 | 15 | |||

| 1987 | -36 | 3 | |||

| 2000-2002 | -38 | 33 | |||

| 2007-2009 | -50 | 17 | |||

| 2020 - ? | -19 | 1 month |

As you can view, the time frame of bear markets is all over the map. Quick bears were in '60, '66 and 1987. Longer term, more worrisome bear markets ocurred in '46, '73-'74, 2000-2002. My father started managing pension fund money in early 1973 and surely can attest to the pain of that bear market.

The current bear market is an infant toddler, at just under one month now using the Feb. 12th Dow Jones high close.

Here's the concerns and opportunities.

First, your portfolio is rarely all stock-based, so your "personal" bear market may look very different than the table above. Owning bonds and cash - even Gold - would normally reduce your overall losses in a stock market decline.

Also, don't fret over small losses. Very few investors sell at the top. And when you sell, you immediately have another decision down the road; where to invest next, or when to get back in. It's your mix of stocks and bonds that will determine most risks in investing. So let's use the word "exchange" rather than sell when moving money around. Don't you feel better already?

Try this exercise: Track your performance of all your accounts for a day, or a week, PREFERABLY when stocks move up and down a lot, like now. Then track the Dow Jones Industrials against that for the same time-span.

If your accounts lost 3% yesterday, when the Dow lost 7%, then your "BETA" is 0.42. Three divided by 7. That is, your money lost 42% of an all-invested basket of stocks (the Dow Jones 30 stocks).

It's a bit technical, but optimally, you want a lower beta in a bear market in stocks, and a higher beta in bull markets. A beta of 1.00 would show you move in lockstep with the Dow. A beta of 1.30 shows you are agressive and will get a 30% gain over the Dow Jones. A negative beta of -1.00 would show your portfolio goes up dollar for dollar when stocks go down. Gold and precious metals vs. stocks, for instance are noted for their negative beta.

Your IRA may be in mutual funds and some Gold funds, what's your BETA? Your brokerage account contains more speculative stocks; what's that BETA? That one number will tell a lot about how you are invested risk-wise.

Generally, younger investors should have higher betas that older investors. If you're nearing retirement, your beta should normally be no more than 0.50. Why?

It takes longer to recover your money in stocks if your losses are greater at the end of the bear market. A 20% loss takes a 25% gain to get even, a 30% loss takes 43% to get back to even. If your beta is lower, you'll generally lose less in the bear stock market, and can recover your money faster in the ensuing bull market.

That could be uber-important if you have cash needs during that time, or are planning to retire not knowing when the bear market will end. The 2007-2009 bear market took 17 months to play out.

Could you postpone spending or delay your planned retirement by 3+ years if most of your money was in the stock market? The 2007-2009 bear market didn't get back to even on the Dow Jones until the Spring of 2011, a full 40 months later!

If I were to ask you what your risk reduction strategy is, how would you answer? Think about it. Some valid answers would be: lowering your portfolios beta, setting stops to sell to avoid large losses; buying an annuity or short term bonds with less risk than stocks? Adding Gold to your holdings. Ask your advisor what his plan is for you.

Hope this sheds some light on how to improve your portfolio management, and how risks are handled in our modern investing era. Call or e-mail with questions or comments.

Thanks for reading!

Barry Unterbrink is a fee-based Chartered Retirement Planning Counselor and wealth manager since 1982. As a second generation manager after his father Larry (1934-2021), they managed institutional pension funds totaling $100 million.Both are former Investment Advisory Presidents and financial newsletter publishers.

Barry Unterbrink is a fee-based Chartered Retirement Planning Counselor and wealth manager since 1982. As a second generation manager after his father Larry (1934-2021), they managed institutional pension funds totaling $100 million.Both are former Investment Advisory Presidents and financial newsletter publishers.

Tuesday, February 25, 2020

Two Days of Major Wall Street Selling

Stock prices fell hard for the second day on the exchanges, as the selling continued this week, fueled by the uncertainty of the global economics threatened by the spread of the Corona Virus.

Here's the tally on the popular stock averages today. Three percent losses again were the ending to Tuesday, as the Dow Industrials shed 3.1%, and the S&P 500 lost 3%. The Nasdaq Composite lost 2.7%, the bright spot of the group. All 10 S&P Sectors fell today. Bonds rose a tad and Gold FELL after carrying the heavy load Monday. A diversified portfolio of short term bonds, long term bonds, Gold and stocks fell 1% today.

My thoughts on this. Monday, Gold and bonds were a safe bet as stocks initially fell. Then today, more folks sold, and some leveraged players had margin calls and sold off Gold and bonds. Traders we'll call them, often acting on the floor of the exchanges on behalf of their clients.

We'll experience a snap back rally at some point. But will this be enough to get back into stocks? We'll see.

It's easy to lose perspective of things when these short term setbacks are the focus of our money. Here are the pitfalls of acting this way.

Don't view the markets from the high point they reached; that will set you up for failure. No one buys at the low and sells at the high (not more than once a lifetime perhaps). So view your investment dollars in a longer time frame. Unless you just started investing, you have a track record, and many years ahead of you.

* instead of 2 days, look at February thus far.

* instead of 2 days, look at the last 3 months.

* instead of 2 days, look at the last 12 months.

The past decade has been very good for stocks. Really good.

Consider two investors, Good Luck Gary and No Luck Bill. Bill invested in stocks in late 2007 near Dow 14,000; before the great recession started to unfold. Today, he's ahead 5.5% average each year since then. Good Luck Gary had cash to invest near the market's lows in early 2009, near Dow 7,000. Today, he's ahead 13.8% on average year-over-year. A big difference you say. Yes. But sadly, we can't find any Bill's or Gary's to prove these numbers.

Let's take the average of 7,000 and 14,000, as it's more likely that investors bought shares when the market was both falling and then rising. So Dow 10,500 is our entry point now. At 27,000 today, that's a +8.5% annual return. And these tally do not include dividends of 2% or so each year. Not bad.

So, to be a successful investor, you need to know what is working now and take part in it; limit losses, and have a long term view.

If stocks are working, invest in stocks.

If bonds are performing well, invest there.

If Gold and Silver are picking up steam, invest there.

If you are not sure of how to do this, contact me.

You know by now I advocate strongly being diversified with your money, so you don't get hurt when certain investments go against you. Set stop points to protect your profits - or lessen your losses.

I am finishing up an investor quiz that I will post to all who read my blog next month.

Stay tuned, and e-mail or call with any questions or comments.

~Barry

Here's the tally on the popular stock averages today. Three percent losses again were the ending to Tuesday, as the Dow Industrials shed 3.1%, and the S&P 500 lost 3%. The Nasdaq Composite lost 2.7%, the bright spot of the group. All 10 S&P Sectors fell today. Bonds rose a tad and Gold FELL after carrying the heavy load Monday. A diversified portfolio of short term bonds, long term bonds, Gold and stocks fell 1% today.

My thoughts on this. Monday, Gold and bonds were a safe bet as stocks initially fell. Then today, more folks sold, and some leveraged players had margin calls and sold off Gold and bonds. Traders we'll call them, often acting on the floor of the exchanges on behalf of their clients.

We'll experience a snap back rally at some point. But will this be enough to get back into stocks? We'll see.

It's easy to lose perspective of things when these short term setbacks are the focus of our money. Here are the pitfalls of acting this way.

Don't view the markets from the high point they reached; that will set you up for failure. No one buys at the low and sells at the high (not more than once a lifetime perhaps). So view your investment dollars in a longer time frame. Unless you just started investing, you have a track record, and many years ahead of you.

* instead of 2 days, look at February thus far.

* instead of 2 days, look at the last 3 months.

* instead of 2 days, look at the last 12 months.

The past decade has been very good for stocks. Really good.

Consider two investors, Good Luck Gary and No Luck Bill. Bill invested in stocks in late 2007 near Dow 14,000; before the great recession started to unfold. Today, he's ahead 5.5% average each year since then. Good Luck Gary had cash to invest near the market's lows in early 2009, near Dow 7,000. Today, he's ahead 13.8% on average year-over-year. A big difference you say. Yes. But sadly, we can't find any Bill's or Gary's to prove these numbers.

Let's take the average of 7,000 and 14,000, as it's more likely that investors bought shares when the market was both falling and then rising. So Dow 10,500 is our entry point now. At 27,000 today, that's a +8.5% annual return. And these tally do not include dividends of 2% or so each year. Not bad.

So, to be a successful investor, you need to know what is working now and take part in it; limit losses, and have a long term view.

If stocks are working, invest in stocks.

If bonds are performing well, invest there.

If Gold and Silver are picking up steam, invest there.

If you are not sure of how to do this, contact me.

You know by now I advocate strongly being diversified with your money, so you don't get hurt when certain investments go against you. Set stop points to protect your profits - or lessen your losses.

I am finishing up an investor quiz that I will post to all who read my blog next month.

Stay tuned, and e-mail or call with any questions or comments.

~Barry

Barry Unterbrink is a fee-based Chartered Retirement Planning Counselor and wealth manager since 1982. As a second generation manager after his father Larry (1934-2021), they managed institutional pension funds totaling $100 million.Both are former Investment Advisory Presidents and financial newsletter publishers.

Barry Unterbrink is a fee-based Chartered Retirement Planning Counselor and wealth manager since 1982. As a second generation manager after his father Larry (1934-2021), they managed institutional pension funds totaling $100 million.Both are former Investment Advisory Presidents and financial newsletter publishers.

Subscribe to:

Posts (Atom)